International trade plays a significant role in driving the global economy and supporting the entirety of our modern, civilised world. As a result of globalization, businesses of all sizes engage in cross-border transactions, importing and exporting goods to expand their markets and access a wider range of customers and products. However, the complex and diverse regulations involved in international trade can create challenges and uncertainties for traders.

To address these challenges and ensure smooth and efficient trade transactions, standardised trade terms have become a necessity and at the forefront of standardised trade terms stands the International Commercial Terms, commonly known as Incoterms.

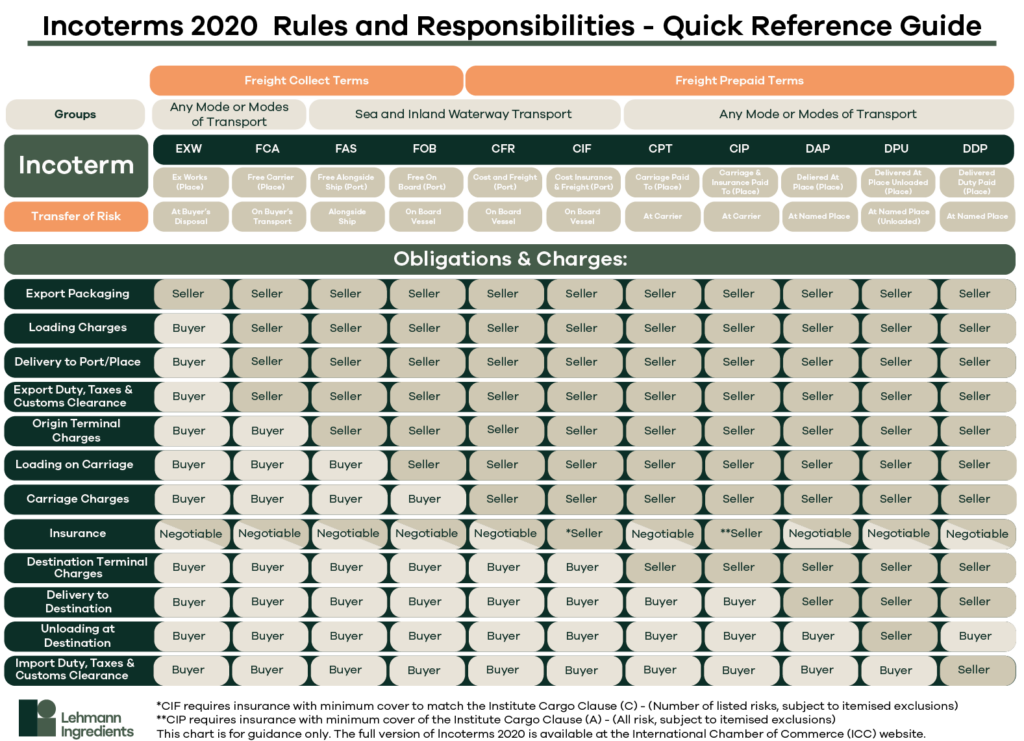

To lay things out more clearly, we’ve created a useful quick reference guide that you can download.

What are Incoterms?

Developed and maintained by the International Chamber of Commerce (ICC) who have a long history of promoting international trade and providing guidelines for business practices, Incoterms serve as a globally recognised set of rules that govern the rights and obligations of buyers and sellers in international trade. These terms provide a common language and framework that facilitates clear communication, defines the responsibilities and liabilities of buyers and sellers, and minimises misunderstandings and disputes.

Incoterms Defined

Incoterms provide a concise and universally understood shorthand to describe critical aspects of a transaction, such as the delivery of goods, the transfer of risk, and the allocation of costs between the parties involved. They ensure that all parties are on the same page regarding their responsibilities and the terms of the trade agreement.

By adopting Incoterms, traders can navigate the complexities of international trade with greater clarity and certainty. These terms help streamline the negotiation process, provide transparency, and enable effective risk management throughout the entire supply chain.

The ICC periodically revises and updates Incoterms to reflect changes in the global trade landscape and address emerging issues. The most recent version of Incoterms at the time of writing is the “Incoterms 2020.” These terms are widely accepted and adopted by businesses and organisations worldwide as the standard reference for international trade transactions.

This article will delve into the various Incoterms, explaining their specific roles, responsibilities, and implications. We will explore how these terms impact the allocation of risks, costs, and tasks between buyers and sellers, ensuring that you are equipped with the knowledge needed to make informed decisions and mitigate potential challenges in your international trade endeavours.

Understanding the Structure of Incoterms

Incoterms utilise a set of three-letter abbreviations to represent specific trade terms. These abbreviations serve as a memorable shorthand reference.

Below we go into more detail about some common Incoterms, and provide a working example of their use:

- FOB (Free on Board): FOB is widely used in international trade, particularly for maritime shipments. Under FOB, the seller is responsible for delivering the goods to the named port of shipment and loading them onto the vessel. FOB signifies that the seller fulfils their responsibility by delivering the goods to the named port of shipment. The risk transfers from the seller to the buyer at the point of loading. The buyer assumes responsibility for transportation, import clearance, and subsequent risks. At this point, the risk and ownership of the goods transfer from the seller to the buyer. The buyer then assumes responsibility for transportation costs, export clearance, and any subsequent risks associated with the shipment.

Example: A manufacturer in China agrees to sell goods to a buyer in the United States on FOB terms. The seller arranges for the goods to be delivered to the port of Shanghai, facilitates export clearance and loads them onto the vessel. Once the goods are on board, the risk transfers to the buyer, who handles the transportation, import customs clearance and duties.

- CIF (Cost, Insurance, and Freight): CIF places greater responsibility on the seller compared to FOB. The seller is responsible for arranging and paying for the main carriage of goods to the port of destination. Additionally, the seller is required to provide insurance coverage for the goods during transit to the port of destination. However, the risk transfers to the buyer once the goods are loaded onto the vessel. CIF exclusively applies only to ocean or inland waterway transport and so is commonly used for bulk cargo, or oversized/overweight shipments.

Example: A seller in India agrees to sell goods to a buyer in Germany on CIF terms. The seller arranges transportation, pays for the freight to the port of Hamburg, and provides insurance coverage for the goods during transit. Once the goods are loaded onto the vessel, the risk transfers to the buyer, who handles customs clearance and any subsequent costs or liabilities.

- EXW (Ex Works): EXW represents the minimum obligation for the seller. The seller’s responsibility is limited to making the goods available at their premises or another agreed-upon location. The buyer assumes all risks and costs associated with transportation, including export and import clearance, as well as any subsequent liabilities once the goods are in their possession.

Example: A seller in Brazil agrees to sell goods to a buyer in South Africa on EXW terms. The buyer arranges for transportation, including pick up from the seller’s warehouse in São Paulo and shipping to South Africa. The buyer also handles export clearance, and import duties, and assumes all risks associated with the transportation and delivery of the goods. - DAP (Delivered at Place): DAP indicates that the seller bears the responsibility of delivering the goods to the named destination. The seller handles transportation, and export and is responsible for delivering the goods but importantly, the buyer is responsible for import clearance and any applicable taxes. The seller assumes all risk until the goods are ready for unloading at the agreed-upon place of destination, where the buyer takes over the risks.

Example: A seller in Germany agrees to sell goods to a buyer in Australia on DAP terms. The seller arranges for transportation, pays for shipping, and handles exports. The goods are delivered to the buyer’s specified warehouse in Sydney, and at that point, the buyer assumes responsibility for unloading, storage, and any subsequent risks including import clearance and tax.

- DDP (Delivered Duty Paid): DDP is a delivery agreement whereby the seller assumes all the responsibility, risk, and costs associated with transporting goods until the buyer receives or transfers them at the destination port. This includes all shipping costs, duties, insurance and any other expenses incurred during shipping.

Example: A seller in China agrees to sell goods to a US customer and agrees on DDP terms. The seller manufactures the items, arranges for transportation, pays for shipping, and handles exports. All duties are paid on both exports from China and imports to the US. The goods are picked up by the courier, again funded by the seller, and are delivered and unloaded to the buyer’s warehouse in the US. This method minimises complications for the buyer and places much of the risk burden upon the seller as they will need to absorb any unexpected costs attributed to delay, tax or damage in transit.

These examples demonstrate the different responsibilities, risks, and costs associated with each Incoterm. It is crucial for traders to understand and select the appropriate Incoterm based on their specific requirements, transportation modes, and desired level of risk and responsibility. Careful consideration of the Incoterms ensures clear communication, smooth transactions, and effective risk management in international trade.

Recent Changes in Incoterms

Incoterms are periodically updated to adapt to changes in global trade practices, address emerging challenges, and provide clarity to traders. The Incoterms 2020 version introduced several notable updates and revisions compared to its predecessor, Incoterms 2010. Some of the key changes include:

1. Introduction of DPU to replace DAT: The Incoterm “Delivered at Terminal” (DAT) was replaced by “Delivered at Place Unloaded” (DPU). This change was made to allow for greater flexibility in terms of the delivery location, expanding beyond just terminals to any agreed-upon place for unloading.

2. Insurance in CIP: The level of insurance coverage required under the Cost, Insurance, and Freight (CIF) Incoterm was amended – CIF is more commonly used for bulk maritime transportation (e.g. raw materials, minerals etc.) where the price per kilo is very low and the requirement of insurance with the maximum level of coverage would result in a policy premium that destroys any seller margin. Parties can of course agree to take out insurance to cover the broader scope however if the payment of the sale is by means of a letter of credit, the higher insurance is compulsory no matter whether CIF or CIP.

3. Security-Related Requirements: The Incoterms 2020 version included enhanced security-related obligations and requirements for buyers and sellers. These changes were made to address the increased focus on security measures in international trade, such as verifying container weights, complying with customs regulations, and adhering to safety standards. As far as customs clearances are concerned, the safety liability lies with whichever party has undertaken the clearance.

Keeping up to date with the latest versions of Incoterms is essential for traders involved in international trade. The revisions and updates reflect the changing landscape of global commerce.

Benefits of Using Incoterms

Let’s explore the key benefits of utilising Incoterms and how they contribute to improved efficiency, cost-effectiveness, and risk management involved in cross-border transactions.

- Clear and Consistent Communication: Incoterms provide a standardised framework and common language for trade transactions. By using universally recognised terms, parties can communicate more effectively and clearly understand their respective obligations and responsibilities. This clarity reduces the chances of misinterpretation, disputes, and costly misunderstandings.

- Defined Allocation of Responsibilities: Incoterms establish clear guidelines for the allocation of responsibilities between buyers and sellers. They outline who is responsible for tasks such as transportation, insurance, export and import clearance, and associated costs. This clarity helps avoid confusion and ensures that each party understands their role and fulfils their obligations accordingly.

- Reduced Disputes and Litigation: By clearly defining the rights and obligations of each party, Incoterms minimize the potential for disputes and litigation. These terms provide a solid basis for resolving conflicts, as they are widely recognized and accepted in the international trade community. This reduces the time, effort, and costs associated with resolving disputes, enabling smoother and more efficient trade transactions.

- Streamlined Processes: Incoterms contribute to streamlining trade processes by providing a structured framework for various aspects of international trade. They specify critical elements such as delivery, risk transfer, and cost allocation, eliminating the need for extensive negotiation and individual agreements for each transaction. This streamlining of processes enhances efficiency and saves time, allowing traders to focus on other aspects of their business.

- Improved Risk Management: Incoterms help manage and allocate risks associated with international trade. By clearly defining when and where the risk transfers from the seller to the buyer, parties can plan and prepare for potential risks effectively. This includes risks related to transportation, damage, loss, customs clearance, and regulatory compliance. Understanding the risk distribution facilitates better risk management strategies, leading to reduced financial losses and disruptions in trade.

- Cost-Effectiveness: Incoterms assist in cost-effective trade transactions by clearly outlining who bears the costs at each stage. Buyers and sellers can accurately assess their financial responsibilities and plan their budgets accordingly. Incoterms also facilitate cost transparency, enabling parties to evaluate and compare quotations from different suppliers or service providers effectively.

- International Recognition: Incoterms are internationally recognized and accepted as the standard reference for trade terms. By using Incoterms, traders establish credibility and enhance their reputation in the global marketplace. The common understanding of Incoterms across different countries and cultures facilitates better collaboration and trust among trading partners.

Common Mistakes and Pitfalls to Avoid

While Incoterms provide a clear framework for international trade transactions, there are common mistakes and misconceptions that traders should be aware of to prevent costly errors. By understanding these pitfalls and following practical tips, traders can navigate through Incoterms effectively and ensure smooth trade transactions. Here are some common mistakes to avoid:

- Not Understanding Incoterms in Detail: One of the most significant mistakes is assuming a general understanding of Incoterms without studying them thoroughly. Each Incoterm has specific implications and obligations for both buyers and sellers. For example, knowing who bears responsibility for paying for duty is key as it is often overlooked, and the cause of most disputes that we see. Failing to understand the nuances can lead to misunderstandings, disputes, and unexpected costs. Take the time to study the latest Incoterms version and seek clarification when necessary. Above all, it’s worth understanding who bears responsibility for paying any duty or taxes that arise as a result of import/export, and in some cases, these can be substantial.

- Making Assumptions: Assuming that everyone involved in the transaction interprets the Incoterms in the same way can lead to problems. It’s essential to have clear communication and a shared understanding of the chosen Incoterm with all parties involved. Documenting the agreed-upon terms in writing, such as contracts or purchase orders, can help avoid misunderstandings and discrepancies.

- Ignoring Local Laws and Regulations: Incoterms provide a framework for international trade, but they do not address specific legal and regulatory requirements of individual countries. It is crucial to consider and comply with local laws and regulations related to customs, documentation, licensing, and other trade-related aspects. Consult with legal professionals or trade experts familiar with the specific country’s regulations to ensure compliance.

- Failing to Assess Risks and Insurance: Each Incoterm determines when the risk transfers from the seller to the buyer. Failing to assess and adequately manage risks can result in financial losses or delays. Additionally, understanding the level of insurance coverage required for each Incoterm is essential. Buyers and sellers should evaluate the need for additional insurance coverage beyond what is specified in the Incoterm to protect against unforeseen events.

- Inadequate Planning and Coordination: Insufficient planning and coordination can lead to logistical challenges and disruptions in the supply chain. Factors such as transportation, documentation, customs clearance, and timing should be carefully considered. It is crucial to establish clear responsibilities and timelines for all parties involved, including carriers, freight forwarders, and customs agents, to ensure smooth operations.

- Not Considering Incoterms in Pricing: The chosen Incoterm can impact pricing and profitability. Failing to account for the costs associated with the chosen Incoterm can lead to financial losses. Buyers and sellers should consider factors such as transportation costs, insurance, customs duties, and other expenses associated with the chosen Incoterm when determining pricing and negotiating contracts.

- Overlooking Currency and Payment Terms: Incoterms do not address currency exchange rates or payment terms explicitly. Traders should establish clear agreements regarding the currency to be used, exchange rate mechanisms, and payment terms to avoid confusion and potential financial discrepancies.

Practical Tips to Avoid Incoterms Mistakes

Disputes are commonplace where a misinterpretation of trading terms or a trading agreement occurs. It is crucial that you take the time to thoroughly understand the Incoterms, their implications, and their specific application to your trade transactions. By ensuring all parties involved have a shared understanding of the chosen Incoterm, and by documenting these terms in writing you can more easily avoid misunderstandings.

- Seek Expert Advice: Consult with legal professionals, trade experts, or experienced professionals in international trade.

- Conduct Risk Assessments and Pricing Implication: Evaluate and manage risks associated with each Incoterm, including transportation, insurance, customs, and regulatory risks. Account for all relevant costs associated with the chosen Incoterm when determining pricing and negotiating contracts.

- Plan and Coordinate: Invest time in planning and coordination, considering factors such as transportation, documentation, customs clearance, and timing to ensure smooth operations.

- Review Currency and Payment Terms: Establish clear agreements regarding currency, exchange rates, and payment terms to avoid financial discrepancies that are not covered by Incoterms.

DAP vs DDP and Brexit

The United Kingdom’s (UK) exit from the European Union (EU) is a great recent example of the importance of understanding Incoterms. While ‘free trade’ on physical goods was agreed upon, customs checks and clearing became a requirement that wasn’t there previously.

Parties who exclusively worked with EU suppliers and customers didn’t have to discern the difference between DAP and DDP when the UK was a part of the EU. Although fundamentally different terms, pre-Brexit they essentially led to the same outcome as there are no checks on inter-EU trade.

However, for businesses who traded on DAP terms before Brexit, the nuance between the two terms (namely who is responsible for clearing customs and paying duties where necessary) became immediately apparent. Severe delays occurred at the border between the UK and EU where this hadn’t been recognised. While the ‘free trade’ agreement meant duties were not applicable for goods originating from and traded between the UK and the EU (see Rules of Origin), there was still the requirement to clear customs which caught many by surprise. Making the situation more difficult was that customs agents were inundated with requests to clear goods from companies who hadn’t needed support previously. Demand for this service greatly outstripped supply, exacerbating the issue.

Today, trade has smoothened between the two parties, but the challenges experienced by those who were unprepared for this change will no doubt live long in the memory.

Conclusion

Understanding and utilising Incoterms is crucial for successful international trade. By studying and comprehending the specific obligations, responsibilities, and risks associated with each Incoterm, traders can enhance communication, minimise disputes, and optimise their trade outcomes. It is essential to invest time and effort in educating oneself about Incoterms and their application to gain a competitive edge in the global marketplace.

To further explore Incoterms and international trade, here are some additional resources:

- International Chamber of Commerce (ICC): The ICC’s official website provides comprehensive information on Incoterms, including the latest updates, publications, and resources. Visit their website at https://iccwbo.org/ for more information.

- Trade Associations and Industry Organizations: Industry-specific trade associations such as The Institute of Export and International Trade, often provide valuable resources and guidance on international trade and Incoterms. Explore relevant associations in your industry to access industry-specific insights and support.

Remember, the successful utilisation of Incoterms requires continuous learning, adaptation, and collaboration. Stay updated, seek expert advice when needed, and proactively apply your knowledge of Incoterms to unlock the full potential of international trade.

Lehmann Ingredients have a 35-year history in the sourcing and supply of ingredients for customers both in and outside of the UK. We are trusted suppliers of premium quality ingredients to a number of established companies leading in various retail categories such as cosmetics and sports nutrition.

We have encountered various types of trade over the years whilst managing our supply chains and as a result have learned how best to navigate terms of trade, and not least Incoterms.

If you have any questions about international trade or wish to discuss your own supply chain needs, you can contact a member of our team by emailing enquiries@lehmanningredients.co.uk or calling +44 (0) 1524 581560.

Request a Sample

used in articles.