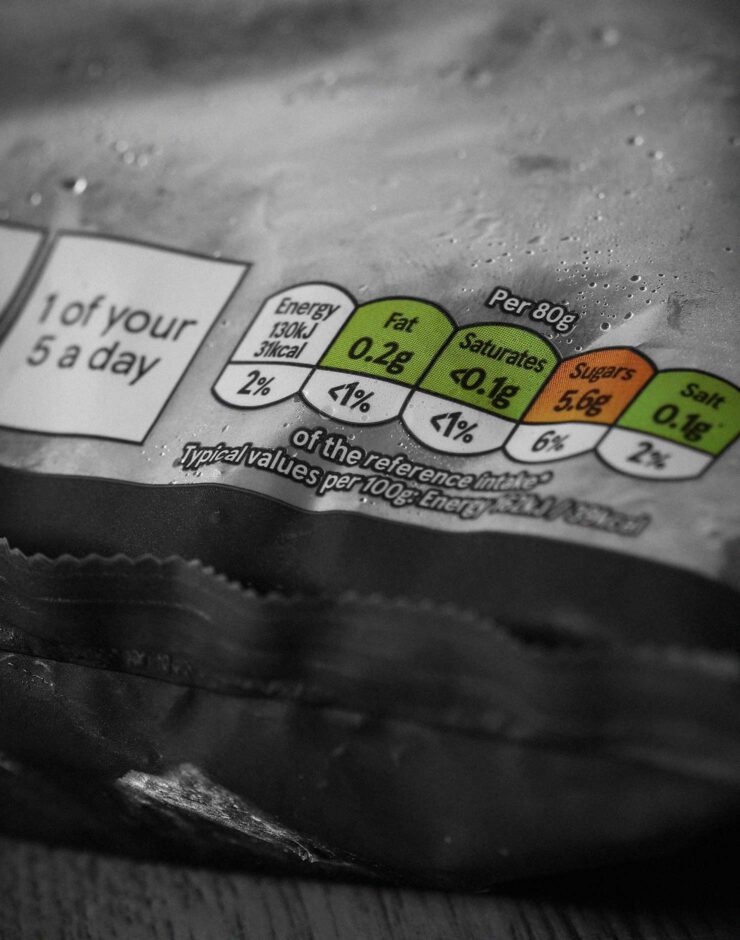

High in Fat, Salt and Sugar (HFSS) foods and drinks have been a growing concern in public health worldwide. HFSS foods are often referred to as “junk” or “unhealthy” foods. Their excessive consumption is associated with an increased risk of obesity, heart disease, type 2 diabetes, and certain cancers. These foods are typically high in calories, low in nutrients, and can lead to poor diet quality. HFSS regulations have been implemented to try and combat this worrying trend.

The issue of HFSS consumption has gained increasing attention in recent years, with health experts, governments, and the public becoming more aware of its negative impact on health. For instance, the World Health Organization (WHO) has recognised the threat that HFSS foods pose to public health and as consumption of HFSS foods has increased dramatically over the last few decades, is now considered an important public health challenge.